Cryptocurrency market analysis and news, New traders

Risk management, RR ratio and position sizing in crypto trades

Contents in this article:

Introduction

Be it small or large, any kind of portfolio needs proper risk management. The whole point of risk management is to allow you to continue trading, as simple as that. It keeps you for making repeated mistakes that can otherwise blow up your account . Keep in mind that one poorly managed trade can wipe out months or even years of consistent positive trading.

The basis of risk management is that it helps avoid making emotional decisions because we do make those type of decisions, we are either hyped or scared to win or lose more assets. With a strict trading plan your trading and investment decisions can be regulated easily. Coming up with a set of rules is the best way to go, each of us is different so not all the rules are the same but a few of them apply to everyone.

These rules have the purpose of managing risk, and eliminate rash decisions, they will allow you to stay in the game more than you would without them.

When creating your risk system you will need to take in mind factors like investment timeframe, risk tolerance, and how much you can risk. An important aspect that you should not forget is that recovering losses is more difficult than creating small profits. Psychologically it plays an enormous pressure on us to know that we started at $1000, we are down at $600 and we need to recover the initial investment. Some even go as far as quitting straight away after the first losses. Don’t forget that being fearful when entering a trade is one of the first signs that you don’t have a good trading plan, everything here is tied together, risk, psychology, trade amount, etc. We’ll dive deeper into the subject.

Portfolio

A portfolio is the mix of all assets you hold or want to invest into. Portfolio diversification is a very important aspect of diversification and should be taken very seriously. A correctly diversified portfolio holds assets from real state to cryptocurrency (eg. Bitcoin, Ethereum, XRP). The portfolio can also be a division of trading accounts across different exchanges or brokers.

Account Size

Simple as it may sound, the account size is very important in risk management. The account size is part of your portfolio risk management plan. For beginners it is important to calculate, allocate and split the account size into multiple smaller accounts. Multiple accounts, multiple strategies. Consider it as A/B testing, each account with it’s own starting balance, it’s own strategy. At the end of the month compare the winners with the losers and see what worked best…. Improvise, overcome, adapt. This also removes the possibility of risking too much.

One example would be : You beleave Bitcoin will go higher in the longterm and have some in your hardware wallet and some in your trading account, the smart thing to do is not to trade the BTC you have in your hardware wallet.

Allocating the capital is up you, you can split it in equal slices or any other way you want, just split it!

Account Risk

I am still amazed of how many people still don’t understand the difference between account risk and account size. The Account risk is determined by taking note of the account size. You will risk x% of your account size on a single trade.

Now there is a fixed rule for this , it’s called the 2% rule and basically it tells you to not risk more than 2% of your account size in one trade. This is where most people get it wrong . The 2% risk size does not mean you trade 2% of your account, it means the loss you might have must not exceed this limit.

In order to establish the 2% of risk you are willing to take on a trade, you first need to establish the entry, exit and stop loss of your trade. You also need to take into consideration that if you’re using leverage that will affect your losses.

Risk/Reward ratio

The risk reward ratio also called RR is the ratio between the possible losses and the possible winning , Risk / Reward. It helps us see if a trade is viable at a glance.

The higher the ratio, the better the trade(Ex. A ratio of 0,5/1 is bad , a ratio of 3/1 is good).The minimum accepted RR ratio at Sublime Traders is 1,7/1 and in rare cases.

This part is where many cryptocurrency signal providers start to act funny, let me explain why. Because signal providers want to have as many signals as possible they post trades that have 1/1 Ratio or even lower. The problem here is obvious for seasoned traders, the thing is you can not be consistently profitable with a 1/1 RR ratio or lower, in fact the minimum is 1,5/1 and you really have to master your entries for this to be viable.

Let me explain further. Say you have a 3/1 RR ratio which is a good ratio, in the long run you win because for every trade you lose 1 and you win 3, this means you only need to win 3,33 trades out of 10 in order to be break even. With a ratio of 1/1 you can not possibly sustain constant profit because the risk and the rewards are the same.

I really can’t stress how important this aspect is please read several times until you understand this aspect perfectly, stop trading 1/1’s, it’s stupid😊

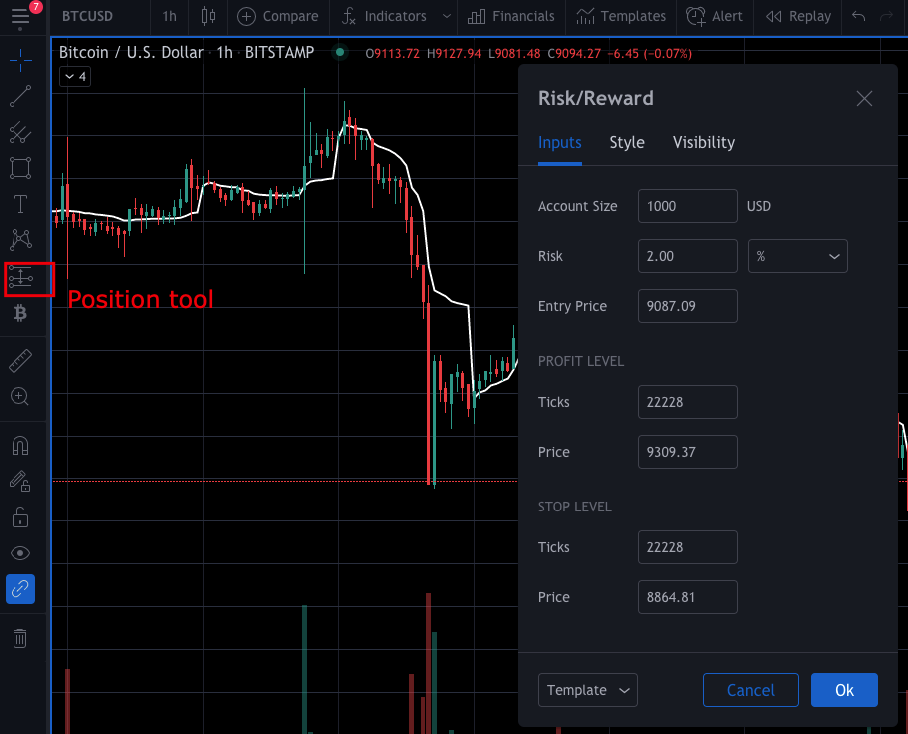

Pro tip : The tradingview chart suite which has been reviewed here offers simple inputs for risk amount and risk reward ratio with the position tool.

Trade Risk

So far we have our account size and account risk , let’s now determine the position size of a single trade. Losses are always part of the game so this needs to be taken into consideration when determining the entry size of your position.

Lets clear things out with a list of to do’s when posting a trade:

- Identify entry

- Identify Take profit

- Identify Stop Loss

- Identify RR ratio

- If ratio > 1,7/1 then post trade (there you go, i created a short if statement for algo trading)

Position sizing

This part is the most difficult when setting up a trade. It takes into consideration or the elements we mentioned before.

Let’s take an example:

- Account size – $1000

- Account risk – 2%

- Distance to stop loss(invalidating point) – 5%

position size = account size x account risk / invalidation point position size = $1000 x 0.02 / 0.05 position size = $400

What this does it it protects your capital from heavy losses and it basically allows you to stay in the game. Remember to add trading fees to your calculation for bigger sizes. Trading fees vary from exchange to exchange but in general they are 0,1% on every trade for spot exchanges, and 0,075% for takers on futures like Bybit and -0,025 for makers (you get paid for limit orders).

Final Word

Our job is to provide clear entry, take profits and stop loss for every trade you post, you on the other hand need to manage your risk properly by following this guide or doing your own research.