In this post we will be trying to analyze the fundamentals of a token that has created some hype and then some distress among traders recently.

What is SushiSwap?

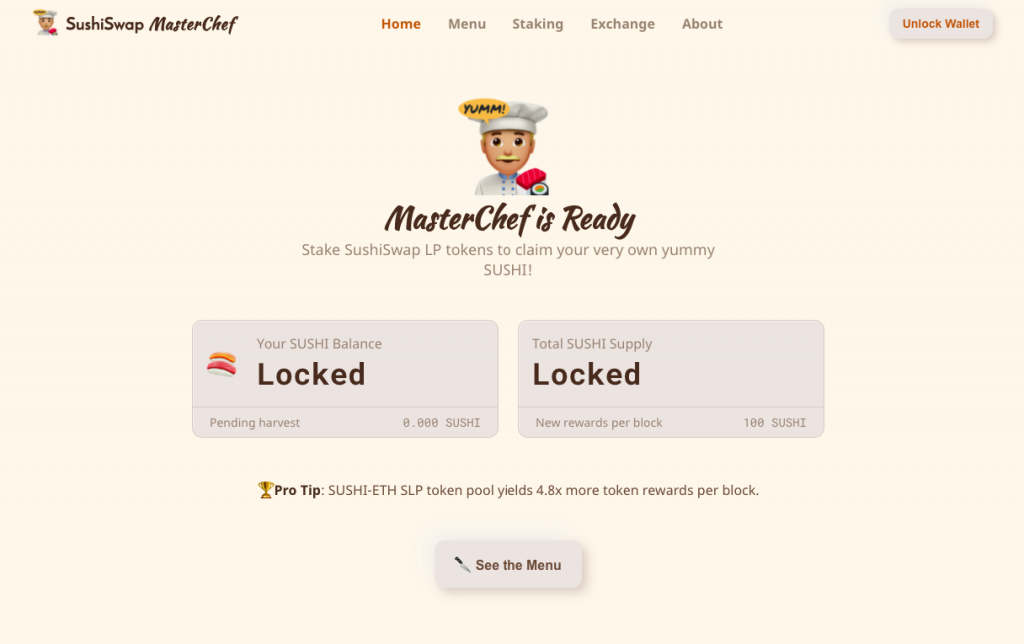

$Susishwap is one of the newest DeFi(decentralized finance) liquidity pool platform. On this platform people can add their ERC Tokens and participate in the liquidity pool to earn rewards. In short, users provide liquidity(ETH) and they get rewards in SUSHI, which is the token for Sushiswap. It provides a high yield investment opportunity for investors as it is now at a 233.55% Yearly reward also called liquidity mining.

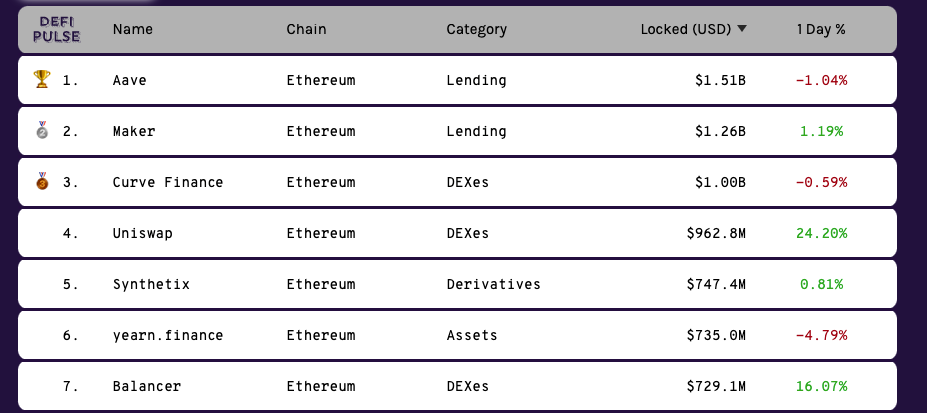

$Susishwap is also a fork of what is known as Uniswap which is one of the most popular DeFi projects right now and which has over $570M in trading every day. Uniswap has been on and off in the top position of the DeFi market even surpassing Maker and Aave on certain occasions.

Uniswap, one of the most popular projects in the DeFi sector, has a daily average trade volume of over $575 million. Uniswap has also taken first place in the DeFi market, reaching over $1.67 billion in total value locked, surpassing MakerDAO and Aave on the list, according to DeFi pulse. Uniswap has had a volume surge recently even taking over Coinbase by almost 20% and this is partly thanks to Sushiswap.

What happened to the SUSHI TOKEN?

So Sushiswap is a bi product of Uniswap and has a token named SUSHI which has dropped almost 90% when the creator (Chef Nomi) decided to cash out after just 1 week. After being confronted by the masses and most importantly by Sam Bankman-Fried, from Alameda Research (Which i appreciate a lot) Chef Nomi has returned the $14M Worth of assets back to the contract.

The advantages of SushiSwap

Because the platform is community drive, there is no KYC and the users are rewarded the native token for contributing to the liquidity pool. The SushiSwap reward model allows 0,25% directly to the liquidity providers and 0,05% are converted into the native token for long time holders.

The process of providing liquidity on the market is easy and anyone can do it, you just need to connect your metamask and you’re ready to go.

The potential problems with Sushiswap

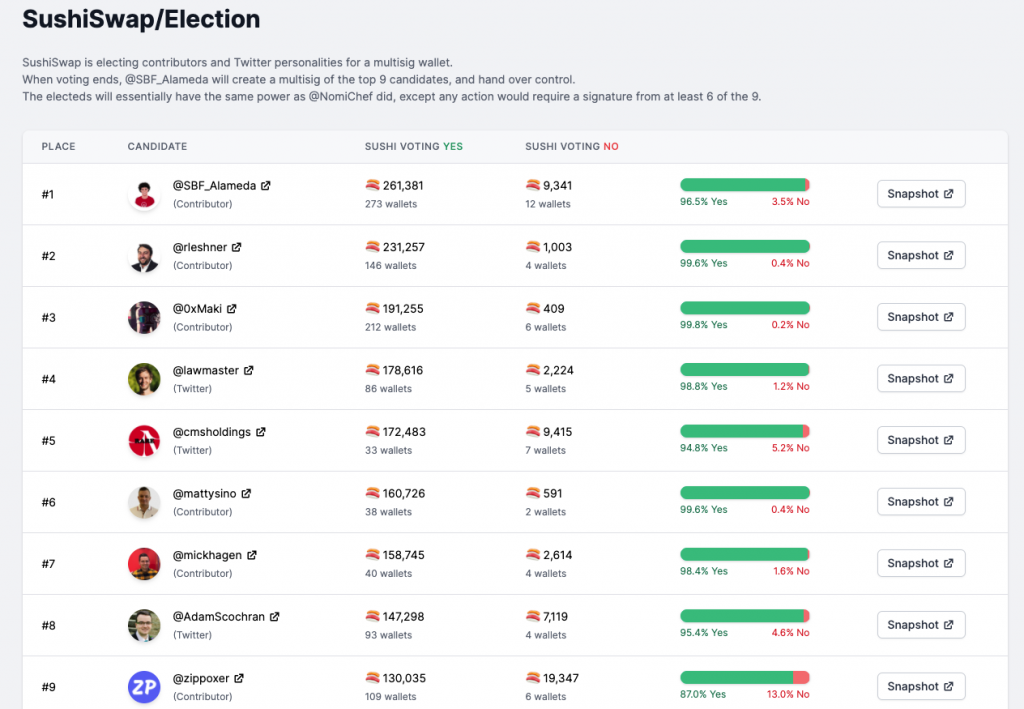

The past event where the creator has sold a lot of tokens thus dropping the market price is one of the worst case scenarios that can happen to a token. This was the case with multiple ICO’s back in the day and will still be the case on non multisig protocols.

The future of SushiSwap

But there is light at the end of the tunnel, the creator has said his “sorry” and handed the protocol entirely to Alameda Resources and they in turn have turned the protocol in a multisig one , meaning that any important action done on this protocol must be “signed” by at least 6 out of 9 elected contributors.

Overall the project is very interesting and offers users incentives to lock and trade the SUSHI token and theres a good chance that the project continues the ascent back to previous levels if the top contributors do the right actions in the future.