08 Nov

Trading is a demanding activity, and the 2022 market certainly doesn’t help new or seasoned traders for that matter get away with poor entries. For this reason we created a trading strategy that uses TA, the Averaged entries, hedging and the awesome automation that Cornix has in order to provide the best consistency we can. CWH comes from some elements that we use in this strategy (Crazy Weighted Hedges)

The goal

The goal of this service/channel is to provide an automated (almost set and forget) solution that will provide consistent profit over time. Think of it as your own “pocket” crypto hedge fund. The service is NOT similar to any solutions available on the market like DCA bots that you would find with 3Commas or Cornix.

Prerequisites

In order to benefit from the full potential of the service you will need:

- Sublime Traders Full subscription , you can get one on our pricing page.

- A Bybit account, if you don’t have one, you can get one here.

- A Cornix account that would let you execute the trades properly.

What to expect

- The goal of this channel is to produce +/- 0.4% daily profit on your account with minimal to no intervention. There are times where the strategy will produce up to 2% percent daily.

- The current iteration of the strategy features a telegram channel and trades based on 100x leverage 🙈. Don’t be scared, it is not as risky as it sounds.

- Our automated system posts trades on the following USDT pairs: BTC and ETH , with several others that will be added over the time.

Starting capital

We highly recommend that you start slow, start with a small account of several hundred dollars , get used to the strategy and then incrementally add more. There is no minimum or maximum recommended, this is entirely up to you.

The general CWH trading strategy

In order to get the best price we can for our positions we need to use multiple entries. These are determined by placing strategic buy and sell limit orders at pre-determined distances, much like a grid. If we are going long we will have several buy limit orders and as the price goes against us we will execute more of those, lowering our entry price and providing for a better average entry price. The inverse goes for a short position.

Our pre-determined parameters for this type of entry are: number of entries, the entry range and the take profit.

The mindset we have with this strategy is to go for small profits and repeat as much as possible. We get in, if price goes against we have another entry , so on and so forth until we either hit all entries or the take profit. More on managing over-extended positions in a lower chapter.

CWH trading strategy- general settings

- We do not use a stop loss

- Our entry zone covers 6%-7% price range

- We use 8 fixed entries with the fixed % allocation allowing us to get a better average entry point and increasing the possibility of us closing with a trailing stop loss.

- The take profit is fixed and uses 0.4% trailing stop above average entry price. Meaning that if the trade goes against us and we fill multiple entries, the initial take profit will be ignored and the strategy will close the position as soon as we are in the green with a minimal distance of 0.4% from our AEP(average entry price)

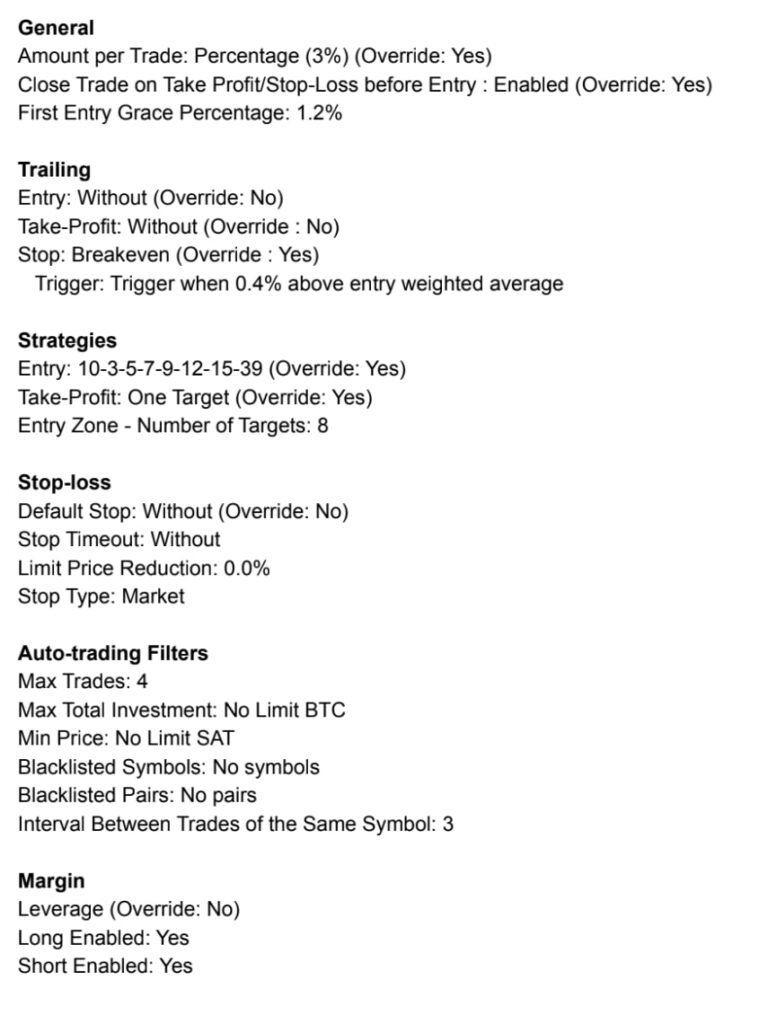

Client side settings

Please refer to these recommended settings for your cornix client. If these settings are not respected, the strategy will not work.

How to get out of a negative position – CWH trading strategy

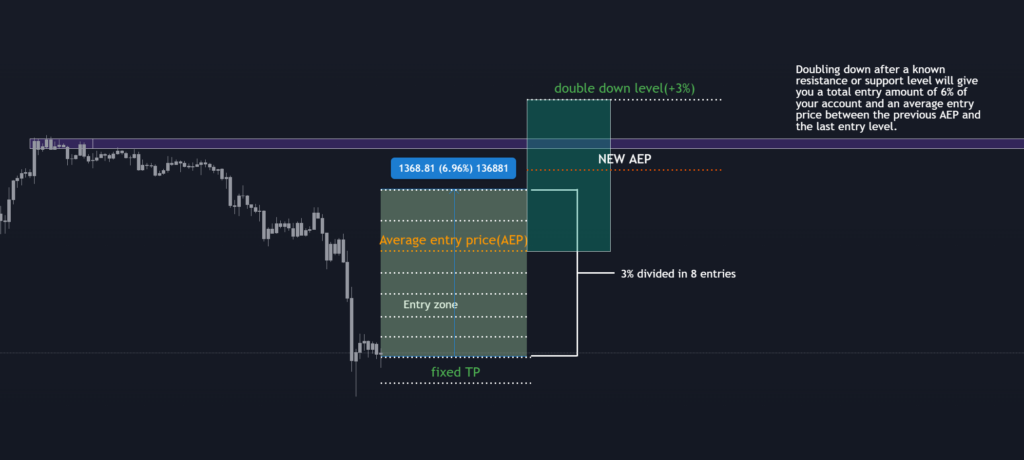

Some trades will unfortunately go out of the range, it is unavoidable but it is for the same reason we need to stick to the strategy and not in a foolish way. The only way to get out of a trade gone out of the range is to double down on your total amount invested in the 8 entries thus far. This is one of the main reasons we are using only 3% of the capital and not more.

Example of a recovery trade:

Ways to further decrease risk

No strategy comes with 0 risk, and this one is no exception. For low risk tolerance traders there are some ways to reduce the general risk.

One of those would be to change the 3% traded amount to a fixed amount, this will ensure that the strategy will only trade on a fixed amount and this way you will limit the exposure the bot might get after compounding 0.4% every day.

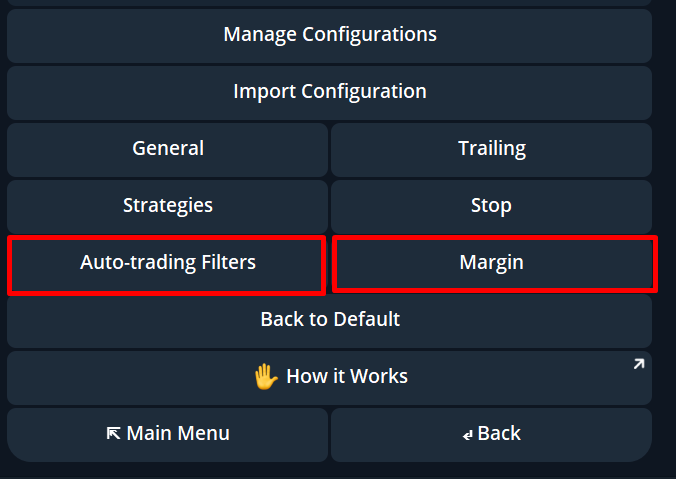

Another option would be to split your cornix clients into 4 . This risk reducing strategy was suggested by one of our veteran traders and can also suit you. The goal here would be to limit every cornix client to 1 trade instead of the general 4 and lock a direction on each of them.

Example:

Cornix Bybit 1 : Max trades 1 , Long Enabled: Yes, Short Enabled: No – Blacklisted pairs – ETHUSDT

Cornix Bybit 2 : Max trades 1 , Long Enabled: No, Short Enabled: Yes – Blacklisted pairs – ETHUSDT

Cornix Bybit 3 : Max trades 1 , Long Enabled: YES, Short Enabled: No – Blacklisted pairs – BTCUSDT

Cornix Bybit 4 : Max trades 1 , Long Enabled: No, Short Enabled: Yes – Blacklisted pairs – BTCUSDT

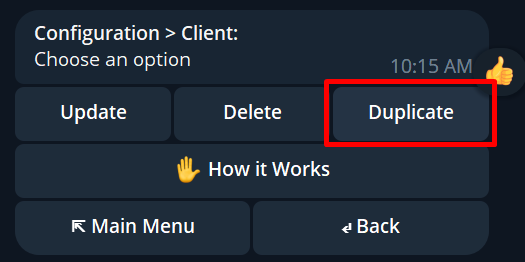

This way you ensure that for every long opened you also have a short opened that protects it. Long loses, Sell wins… and so on. The way you do this is by duplicating your existing clients in cornix.

The reason why this wouldn’t work on a single client is because the order in which the trades come in. For example you can get 3 trades in a row that can be longs and you can get one short. That single short would not be able to cover the already opened longs if 💩 hits the fan.

Other questions you might have

Can i use another exchange?

No, due to the Cornix limitations, we can only use Bybit for this strategy at the moment.

Can i trade large amounts using this strategy?

Yes, but only after you have gotten used to the strategy with small amounts, going head on with a big amount only because other members are doing great is stupid, are you stupid? Didn’t think so .