The majority of new traders on Bitmex are exposed to some trading mistakes that can mess up their portfolio in a big way even get them out of trading altogether. Ordinarily, the BitMex platform has an extremely low barrier to entry, which means anyone with a small starting capital, internet connection, and a computer/ smartphone can become a “trader”. Unfortunately, new traders often learn hard lessons when their investment portfolio is all swept clean after they make common mistakes living them broke and on the REKT list. Here are the 5 most common mistakes new traders do on Bitmex that you should avoid at all costs. You can see our full bitmex signals here.

1. Not using risk management (stop loss, hedging, and position calculation)

The most important thing one should learn in crypto trading is how to manage risk. Sadly, most new traders put emotions before any logical decisions, which manifest when they refuse to accept losses (stop loss), not hedging, and failing to calculate their position. Trading without stop loss means they refuse to accept losses, which makes them stay hopeful that a run will change and become profitable in your favour. New traders must learn to accept a loss when trading on these leveraged exchanges so that they can move to the next trade. It is recommended that a trader set a stop loss, and avoid acting on emotions when a trade doesn’t go well in their favour. Hedging can strategically help a new trader leverage risks, while position calculation ensures a trader only risks a certain percentage of their total account capital. New traders failing to take such important initiatives may blow away their investments in a flash.

We have a full on article on risk management here.

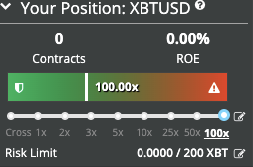

2. Leveraging too high

New traders often make the mistake of over-leveraging their trades, which leads to massive losses in Bitmex. While Bitmex allows you to borrow 100x against your deposited crypto coins, just a slight move in the price of say 0.5% will get you liquidated. The best strategy is to leverage low, maybe 10x maximum, although it’s advisable to keep it at 5x to be safer.

3. Not taking liquidation price into account

Getting liquidated means you lost all the money you put up on a single trade. For example, if you risked 1 at 20x leverage(so 20 BTC), Bitmex will give you a liquidation price when you place a trade. If the trade goes the wrong way and you hit the liquidation price you will lose your 1 BTC just like that. That’s a 100% loss. Most new traders are not really educated on the liquidation price, which means they fail to take precautions on this aspect.

Important aspect to take into account , at X100 if the price moves the “wrong way” just 1% you’re out.

4. Not taking the funding rate into account

Funding Rate is a small fee paid by one side of the contract to the other. For example, Longs pay Shorts or vice versa. It is meant to encourage the price of the perpetual futures contract to stay near the underlying spot index price. The funding rate is calculated by combining interest and the premium/discount rate. The problem with new traders on Bitmex is that they don’t consider the fact that when they sell short or margin trade then they are borrowing some big fish’s coins and paying interest to them. Funding rate can either eat into your money, leading to losses.

Let me clarify the problems here, new traders either don’t take into account that they will pay a fee every 8 hours and they also ignore the fact that when the funding round is ending there will be positions on the other side ready to take the fundings and often we have situations where the price changes direction exactly after funding.

5. Not using all the available futures contracts

Bitmex has two main types of contract options: Futures contracts and Perpetual Contract. When you use all the available futures contracts, you are assured that at one particular point the contract will be settled automatically. A futures contract for December 2020 might get priced at $14,000 when the current price is around $5,000.00. Most new traders on Bitmex don’t bother to play with these Futures Contracts, which exposes them to losses in the perpetually volatile crypto prices.

6. Final thoughts

Trading on Bitmex is challenging, particularly to newbies. By recognizing and learning about common mistakes new traders make, you can avoid getting into such difficult situations. Keeping off these avoidable mistakes will increase your rate of success on Bitmex.