29 May

The world of cryptocurrency trading is a roller-coaster ride of high rewards and potential substantial risks. Given the volatile nature of this market, robust risk management strategies are not merely optional but absolutely essential. However, despite the clear need for such strategies, recent trends show a worrying disregard for risk management, leading to significant losses and even the collapse of prominent cryptocurrency ecosystems.

Even if your compass for predicting market trends isn’t always pointing north, solid risk management can be your lifesaver in the stormy seas of cryptocurrency trading.

A survey conducted in 2023 by global market research company CoreData found that 70% of advisors believe there will be more cryptocurrency failures this year than the last. More than a quarter (26%) expect to see the asset class collapse on a larger scale than was caused by FTX and Sam Bankman-Fried in November 20221. These sobering predictions underscore the need for traders to approach the crypto market with a well-informed understanding of risk management.

For instance, in the beginning of 2023, many companies offered financial products with interest rates significantly higher than those of traditional banks, with yields of up to 18% and 20%. However, these get-rich-quick schemes quickly fell apart when the market turned downward, leading to the bankruptcy of Celsius, a major lender, and the collapse of the Terra-Luna ecosystem2. The concentration of power in the hands of a few individuals, a stark departure from the intended decentralization of the crypto space, further increased the market’s vulnerability2.

For both novice and experienced traders, the essence of risk management in cryptocurrency trading lies in the ability to protect capital and prevent catastrophic losses. One well-regarded approach to risk management is the 2% rule. This rule dictates that a trader should risk no more than 2% of their trading capital on any single trade. Position sizing, which determines how many coins or tokens a trader is willing to buy, is a critical aspect of this strategy3.

The shark bite

Dr. Alexander Elder, who proposed the 2% rule, compares the risk to a shark bite. The potential losses could be as catastrophic as a shark bite if a trader invests a substantial amount of their capital in a single trade. He also suggests limiting trading sessions to 6% per session to avoid a situation comparable to a piranha attack, where small losses accumulate over time until they consume all of a trader’s capital3.

Trading in the crypto market requires both proactive and reactive measures. As such, traders must know when to take profits and losses, set stop-losses, and never risk more than they can afford to lose. This strategy is echoed by DayTradify on Twitter, who stated that “Cryptocurrency trading is all about risk management”4. Crypto Rand further emphasized the importance of implementing risk management mechanisms, such as setting stop-loss orders and using dynamic risk-reward ratios to preserve the integrity of trading strategies5.

The Crucial Role of Risk Management in Crypto Trading

Risk management in the realm of cryptocurrencies is not just an option; it’s a necessity. According to a recent study, an estimated 90% of crypto traders fail within their first year due to a lack of proper risk management strategies. Trading without a clear risk management plan is akin to navigating a ship in stormy seas without a compass. Your chances of staying afloat are slim.

Why Do Many Crypto Traders Fail?

The primary reason why a high number of crypto traders fail is due to their inability to manage risk effectively. These traders often get drawn into the allure of quick profits and neglect the potential pitfalls. As a result, they make impulsive decisions, succumb to market panic, or risk more than they can afford to lose.

Embrace the Power of Diversification

One of the most effective risk management strategies in crypto trading is diversification. Spreading your investments across different cryptocurrencies can help mitigate the risk associated with a single cryptocurrency’s potential downfall. This tactic follows the old adage, “Don’t put all your eggs in one basket.”

The Importance of Position Sizing

Position sizing is a critical component of a solid risk management strategy. It’s a trading principle that dictates the amount of your total capital that should be risked in a single trade. One widely used position sizing formula is the “2% rule,” which suggests that you should never risk more than 2% of your trading account on any single trade. This rule helps ensure that a single loss won’t significantly deplete your trading capital. Additionally, the 2% risk rule is more complex than it might seem, read the full article on risk management in order to get a better understanding on how this all works.

Stop-Loss Orders: Your Safety Net

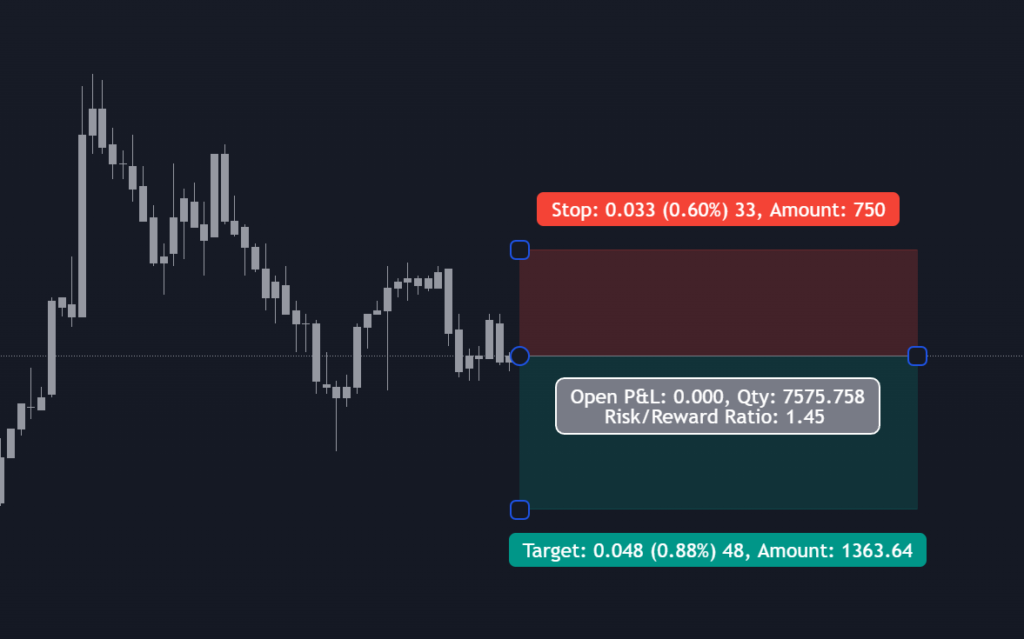

Stop-loss orders are another essential tool in your risk management arsenal. They allow you to set a predetermined price level at which your trade will automatically close, thereby preventing further losses. According to industry statistics, traders who regularly use stop-loss orders are 60% less likely to experience a total loss of their investment.

Risk to Reward Ratio

Understanding and applying the risk to reward ratio is also vital in crypto trading. This ratio helps determine the potential reward for every unit of risk taken. A common recommendation is to look for trades where the potential reward is at least twice the risk – a risk to reward ratio of 1:2.

Regular Market Analysis

Successful crypto traders not only have a keen understanding of risk management strategies but also perform regular market analysis. Both technical and fundamental analysis provide crucial insights into market trends, helping traders make informed decisions.

In conclusion, the risk inherent in cryptocurrency trading cannot be eliminated, but it can be managed. By implementing sound risk management strategies like the 2% rule, diversifying investments, and setting stop-loss orders, traders can navigate the crypto market’s volatility and maximize their potential for profit. As we proceed through 2023, it will be crucial for traders to heed the lessons of the past and prioritize risk management in their trading strategies. After all, the key to success in cryptocurrency trading lies not just in seizing opportunities for profit, but also in ensuring the preservation of capital in the face of potential losses.