13 Feb

Hey traders,

It’s time to update you all on the Scalping channels, what they mean , how to use them correctly and how to configure cornix for the best usage.

First of all let’s set the expectation bar

The scalping channels are automated, meaning that no admin checks a trade before being posted, at least not in real time. Now it can happen that if we notice a trade in what we (as humans) consider to be the wrong direction, we cancel it , but it is an outlier situation mostly.

Trades can come from one of our 3 algos and can have multiple types: range entry two targets, range entry one target, single entry two targets and single entry 5 targets.

Strategies we use as trade identifiers

Evolution of the CWH algorithm that some of you have tested, the range two targets strategy is the safest all rounder strategy for a headless automated bot. Why headless? For us a trading strategy is headless as long as it does not take any fundamental input from the market as social sentiment and trading news. At the current state of our algo evolution we are only using TA and orderbooks in order to take trade decisions.

Now this is not a limited approach , we can assure you the algos are pretty complex, but the solution is not complete in our eyes, and we want you to be aware of this as it can have an impact on your trading.

The range entry two targets is the safest approach we found with automated TA/OB trading at the moment as it leaves some breathing room for the price to move, wick and fake.

There are also some variations of this strategy we can use, with one target or fixed entry five targets. The bottom line here is that if it is active it passed a series of tests.

Backtesting vs real life

Age old debate, is backtesting telling us something about the futures. Short answer is Not really, but it doesn’t mean that we should’t do it. Backtesting does give us some insight about the future but limited. We can optimize parameters and timeframes for a given pair and the results in real life can be totally different… why ?? well we come again to the headless aspect of trading bots in telegram. When we manage to have sentiment and news directly integrated as weighted trigerring conditions, our backtesting will take another dimension.

Trading bots and algos, not the same thing

In our precise case a trading bot is not the same thing as a trading algorithm, let me explain why. Our signals come from our algos in a neatly written syntax that our favourite telegram trading bot (cornix) can understand.

So , to simplify , we have the algo that is throwing the signals and cornix that catches it, interprets it and executes it , therefore we have two categories of bots:

– Trade identifier

– Trade execution

A trading strategy needs both to work well, a good identifier and a good executer, for if one of them fails the trade has all the chances to do the same.

We already talked about our strategy in the strategies we use section now let’s talk about cornix and how to configure it in order to get the best of our channels.

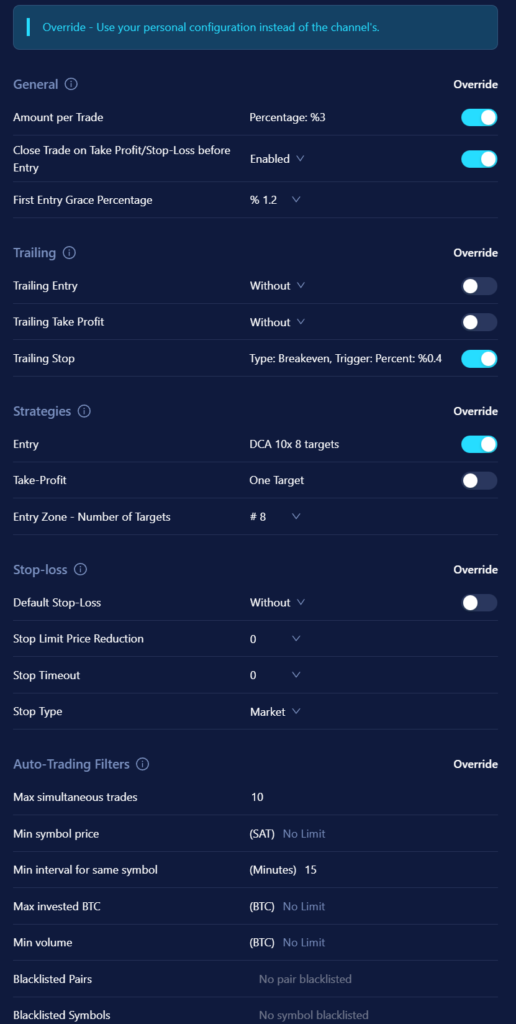

How to configure cornix to get the best out of the channels

First of all you must know that the ability to auto follow trades is active on the scalping channel and the swing channel because it was a popular request , if it were for us it would have been deactivated… why? because it does need some human interaction for it to be profitable. Remember… headless… that’s why!

If you truly want to be profitable in trading we recommend that you follow signals manually with the follow signal button.

The cornix config can be simple as we already use at the moment or complex as we do on the CWH channel.

Simple version

– Amount per trade 3%

– 4 Entry targets

– Evenly divided as is the setting used by the channel by default.

– Trailing stop loss moving target: meaning at TP1 we move SL to breakeven

CWH version

This version is a bit more complex and has indeed been designed to be used in a no SL trade environment but can be just as good in the current state of the signal types.

The main difference here with CWH is that we do not override a single target, we let cornix use whatever it parses from our Trade identifier.

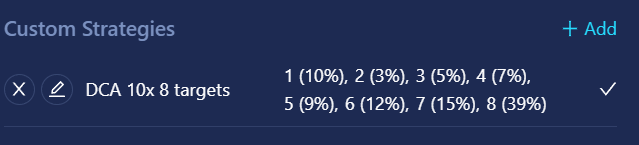

You will also need to configure an entry strategy that should look like this:

Other notes

- We really want to add diversity in our trading, every action we take is in this direction. However we do not want to let diversification stand in the way of safety. For this reason we decided to stick to BTC and ETH as pairs for our scalping signals for now.

- We will also continue to update the algos every time we deem necessary with a minimum frequency of once per month

.