16 May

Learn what is Impermanent loss and how to control it. You can also limit the amount of impermanent loss you experience by reducing your trading fees and choosing assets that are less volatile. Learn how to minimize impermanent loss by choosing the right asset class. In this article, we’ll cover how to calculate impermanent loss, and control it with your trading fees. And, last but not least, how to control the amount of impermanent loss you suffer.

Calculate impermanent loss

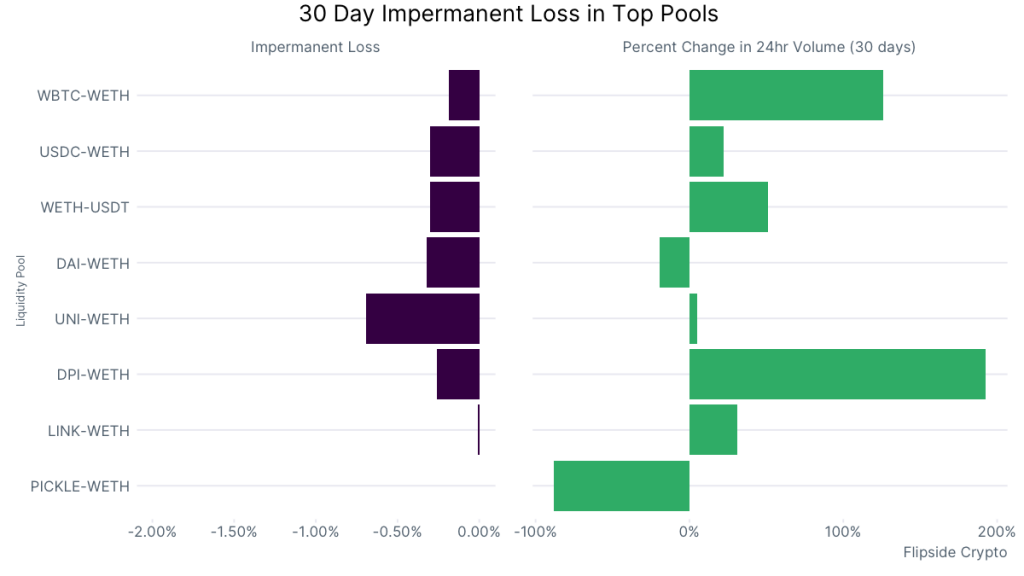

In the uniswap v2 platform, there is a built-in method to calculate impermanent loss. This method involves using the constant product formula. The calculation of impermanent loss is crucial for investors who want to understand how to calculate their losses before investing in a digital wallet. By using this method, you can determine how much of your daily yield is at risk, and you can use it to assess how much risk you are taking.

The process of calculating impermanent loss is fairly simple. First, you need to understand how liquidity affects asset prices. In decentralized finance, liquidity is essential because it affects asset prices. While liquidity has a downside risk, the good news is that it can be counteracted later. By keeping a portfolio liquid, it can counteract the impact of a sudden price decrease. But in traditional AMM, it makes the investment a bad one – it forces you to sell your outperforming assets to buy underperforming ones. Moreover, when a market rally occurs, the liquidity provider keeps selling the outperforming assets, which means they can no longer profit from any subsequent price rises.

In the first scenario, the loss will be 1.03%, because the price of the stablecoin increases. The impermanent loss is greater than the fee earned. When the price of an asset decreases below 100%, the impermanent loss will increase. By using an impermanent loss calculator, you can calculate how much you should withdraw, based on actual prices. You should understand that the calculation method is not a magic formula, and should be used with caution.

If you decide to lock the pair ETH and USDC, you can consider the price change scenario and the corresponding impermanent loss. In this scenario, the price of ETH will rise, and the value of USDC will decrease. In the other scenario, the price will decrease. The impermanent loss is the amount of your loss if the price of the ETH goes down. The ETH price decreases. If you lock a pair that moves in one direction, your impermanent loss will be lower than the other.

To make the calculation easier, you can use a simple example. The trader wants to trade one token for another. When he does this, the quantity of the first token decreases and the quantity of the second token increases. In a nutshell, this scenario is the same as a hypothetical scenario. The trader wants to trade token A for token B. As the value of token A increases, the price of the second token will increase. The bigger the divergence is, the larger the loss.

Another example of this type of liquidity provision is yield farming. Using the volatility of crypto prices to calculate impermanent loss is critical. If you’re not experienced in yield farming, this method may help you avoid impermanent loss in your investment portfolio. Yield farming, which uses mirror assets, is a popular method of risk mitigation for these types of losses. You can also use a 50/50 liquidity pool for these purposes. The key is to know the best approach to your specific situation and stick to it.

Control impermanent loss by trading fees

While impermanent loss doesn’t have a good name, it occurs when coins leave the liquidity pool and are lost for good. The fees earned in providing liquidity do not factor into impermanent loss. Moreover, impermanent loss happens regardless of the direction of price movements; only the ratio of price at the time of deposit counts. By using trading fees to offset the loss, you can limit losses while ensuring maximum profits.

The higher the trading fee, the lesser the chance of loss. A 10% APR token pool yields $1,100 at the end of the year. If you invest 500 tokens in the same pool, you will lose 50% of your investment in a year. The trading fees will add up to your total investment. However, it is still important to investigate before investing your funds. Moreover, calculating the impact of impermanent loss upfront will help you make the right choice.

Decentralized exchanges (DEXs) are an integral part of cryptocurrencies. They bring liquidity to hundreds of tokens and offer trading options to users around the world. As of this writing, liquidity providers have committed $67 billion to DEXs, which is more than enough to cover the entire cost of setting up a DEX by 2022. However, one of the key risks faced by these decentralized exchanges is impermanent loss. Lower liquidity on DEXs may reduce the global adoption of these cryptocurrencies.

The liquidity provider suffers impermanent loss as well. The liquidity provider wants to maintain a stable price with fewer large fluctuations. In order to ensure low impermanent losses, a stablecoin is usually included in the liquidity pool. Otherwise, the liquidity provider would include Ethereum x Dogecoin in its liquidity pool – two highly volatile cryptocurrencies. If the liquidity provider withdraws, the impermanent loss becomes permanent. However, this loss can be reversed when token prices return to their original state.

Limit impermanent loss by choosing less volatile assets

Using more stablecoins can reduce the risk of impermanent loss. Stablecoin pairs include USDT and DAI. However, you can still invest in more volatile pools if the rewards are better. Not all liquidity pools require that the asset ratio is fifty percent, so you can choose any combination. It also helps to choose different types of liquidity pools to limit the risk of impermanent loss. Some pools are more complex and require knowledge of DeFi.

In a buy and hold investment strategy, the gains may be smaller than with an investment strategy. However, the loss is permanent when the LP withdraws the funds. An example of this is the difference between buying and selling a cryptocurrency after it has moved from an automated market maker. The difference between the two values is greater for a higher loss and smaller for a lower one. The same applies to cryptocurrencies.

Liquidity providers take a risk by accepting funds in a liquidity pool. However, the losses remain on paper until the funds are withdrawn. Therefore, depending on the market’s movement, the losses may disappear. The best way to limit impermanent loss is to choose less volatile assets. This way, you can avoid making impulsive decisions and limit the risk of impermanent loss.

When investing in cryptocurrency, it is important to understand how the loss affects a portfolio’s value. You must choose less volatile assets and limit the impact of LP’s impermanent loss on your overall returns. The impermanent loss will not be very large if you choose less volatile assets. In contrast, investing in a Uniswap liquidity provider position can decrease your returns.

As the price of a token fluctuates, the risk of impermanent loss rises. The bigger the change, the higher the risk of impermanent loss. DeFi relies on liquidity, which impacts asset prices. In the case of the crypto market, liquidity plays a large role in affecting the price of an asset. In addition to providing liquidity, staking has immediate risks. While this is a profitable practice, it must be tempered with the possibility of losing your investment.