05 Oct

The cryptocurrency market has always been a volatile space, but 2023 brings its own set of unique challenges and opportunities. From the Federal Reserve’s interest rate hikes to the SEC’s delay in approving Bitcoin ETFs, the crypto landscape is evolving at a rapid pace. In this article, we’ll explore the state of the crypto market, the impact of inflation, and how Telegram trading signals can help you navigate these turbulent waters.

The State of the Crypto Market

According to a recent Forbes report, major cryptocurrencies like Bitcoin and Ethereum have been drifting lower due to the Federal Reserve’s hints at another interest rate hike. The SEC has also delayed decisions on Bitcoin spot ETFs, adding another layer of uncertainty. However, despite these setbacks, crypto prices have shown resilience. Bitcoin prices are up 44% year-to-date, while Ethereum prices have risen by 26%.

This resilience can be attributed to several factors, including increased adoption of cryptocurrencies in various sectors, technological advancements, and the diversification of investment portfolios to include digital assets. As the market matures, it’s becoming increasingly important for traders and investors to stay updated on these trends.

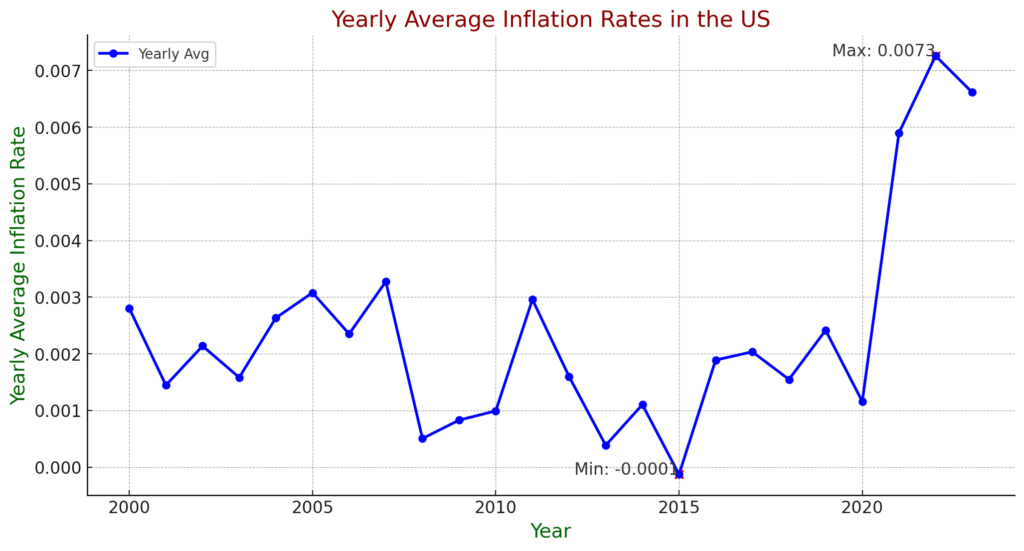

Inflation and Its Impact

Higher interest rates generally mean increased borrowing costs for companies. Many crypto companies collapsed during 2022’s “crypto winter,” and rising rates could put additional pressure on struggling firms. This is where the importance of reliable crypto signals comes into play. By following the best crypto signals, investors can make informed decisions and potentially mitigate the risks associated with inflation.

Inflation doesn’t just affect fiat currencies; it also has a ripple effect on the crypto market. As the cost of goods and services increases, the purchasing power of both fiat and digital currencies decreases. This is why it’s crucial to have a diversified investment strategy that can withstand the pressures of inflation.

Regulatory Developments

The SEC’s delay in approving Bitcoin ETFs has been a significant point of contention. However, the regulator has approved several cryptocurrency futures ETFs, indicating a slow but steady move towards acceptance. Congressional members have also urged the SEC to begin approving spot Bitcoin ETFs, stating that there is “no reason to continue to deny” them.

Regulatory developments are not just confined to the United States. Countries around the world are grappling with how to regulate cryptocurrencies, and their decisions could have far-reaching implications. For instance, the European Union is considering stringent regulations that could impact the crypto market significantly.

The Binance Conundrum

Binance, the world’s largest crypto exchange, is facing its own set of challenges. The SEC has charged Binance and its co-founder with operating illegally in the U.S., and its U.S. revenue has dropped 70% year-to-date. For traders using Binance, this is a crucial time to follow Binance signals to stay updated on market trends and make smart trading decisions.

The issues facing Binance are symptomatic of a larger trend affecting crypto exchanges worldwide. Regulatory scrutiny is increasing, and exchanges must adapt to meet these new challenges. Failure to do so could result in significant financial and legal repercussions.

The Role of Telegram Trading Signals

In a market as volatile as crypto, having a reliable source of trading signals can be a game-changer. Telegram trading signals offer real-time updates and insights, helping you make timely and informed decisions. Whether you’re trading on Binance or any other platform, these signals can provide invaluable guidance.

The benefits of using Telegram for trading signals are numerous. The platform offers end-to-end encryption, ensuring that your data is secure. It also allows for the quick dissemination of information, making it an ideal choice for traders who need to make fast decisions.

Best Crypto Signals for 2023

As we navigate the complexities of the crypto market in 2023, it’s crucial to rely on the best crypto signals. These signals offer a comprehensive analysis of market trends, potential investment opportunities, and risks, helping you make well-informed decisions.

The quality of the crypto signals you follow can make a significant difference in your trading outcomes. It’s essential to choose a provider that is reliable, well-researched, and timely in their updates.

Future Outlook

According to experts, regulatory clarity could give a much-needed boost to the market. Any updates on Bitcoin ETF approval could dominate the crypto space, and a favorable outcome would be a significant positive. Therefore, keeping an eye on crypto signals and Binance signals can offer you a competitive edge.

The crypto market is still in its infancy, and much can happen in the coming months and years. Technological advancements, regulatory changes, and economic factors will all play a role in shaping the market.

Empowering Your Crypto Journey in 2023

The crypto landscape in 2023 is fraught with challenges but also brimming with opportunities. By staying updated through reliable Telegram trading signal groups like Sublime Traders, you can navigate this complex market with greater confidence. After all, in a rapidly evolving space like crypto, information is power.

By arming yourself with the right information and tools, you can not only survive but thrive in the crypto market of 2023. Whether you’re a seasoned trader or a newcomer, the importance of staying informed cannot be overstated.