11 Mar

As individuals that have been involved in banking, trading and cryptocurrency over the last 13 years, we wanted to take a deep dive and shed some light on a recent event that could have significant consequences for the startup and tech economy and potentially the cryptocurrency market.

What is SVB ?

Silicon Valley Bank (SVB) is a Californian (Santa Clara) brick and mortar bank which has over $160 billion in uninsured customer deposits (95% of their total deposits). It recently failed, triggering a potential domino effect throughout the tech and startup world. SVB is a crucial bank for startups as half of all venture capital-funded startups in the US are customers of SVB, which amounts to around 65,000 startups.

The Fall of SVB

The panic movement in the markets began on Thursday when SVB disclosed that it was seeking to raise capital quickly to deal with massive customer withdrawals, but was unable to do so. The announcement surprised investors and rekindled fears about the solidity of the entire banking sector, particularly with the rapid rise of interest rates that is driving up the cost of credit.

The failure of SVB could lead to startups missing payroll, which could be disastrous for the tech and startup economy.

This recent failure is significant as SVB was the second-largest banking failure in US history and the largest since the 2008 financial crisis. The bank’s primary reason for failure was its decision to invest its customers’ deposits in treasury bonds with fixed interest rates, which lost value as interest rates shifted. With $80 billion in bonds yielding an average of 1.5%, the bank’s investment strategy was not sustainable.

The shady part of Silverbank

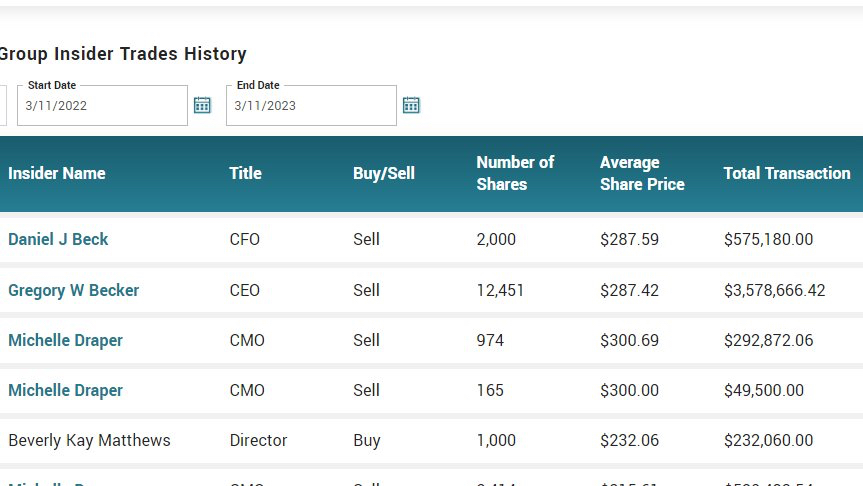

Moreover, right before the bank’s collapse, its management team sold some or most of their stock, with the CEO, CFO, and CMO selling 11%, 32%, and 28% of their stock, respectively. This raises questions about whether they knew something was amiss. Good think that stocks are more transparent than crypto, and it was supposed to be the other way around.

Furthermore, it seems that among it’s clients, FTX has also held funds with the bank . This all could be another answer to the liquidity issue that started the fall of SVB.

Nobody expected the crash

Keep in mind that SVB was noted by major analysts as a BUY opportunity.

One month ago, Jim Cramer urged investors to buy Silicon Valley Bank stock when the price was at $320 . Jim Cramer…. again, i guess an algo that does the opposite of what he says should be created.

What’s next?

In a recent tweet, Elon musk stated that he would be opened to the idea of buying SVB and turn it into an online banking platform.

If this happens it would be good in the short term, but in the long run it would centralize even more power in the hands of Musk.

USDC de-pegging

Turns out , some of Circle’s USDC reserves were held at SVB , the news of the bank failure has caused the stablecoin to de-peg , causing a -14% peak in the pairing against USD.

The SVB crash news comes at a time when BTC is dropping, after a small attempt at a rally , the price seems to continue on the downside as investors and traders find a bearish sentiment invading the markets.