23 Apr

There are many indicators you can use to predict the future direction of the market. These indicators include the Simple Moving Average (SMA), the On-Balance-Volume (OBV), the Relative Strength Index (RSI), and the Fibonacci retracement indicator. However, the most important tool to have in your arsenal is a good charting tool. This article will walk you through some basic indicators you can use profitably.

Simple moving averages (SMA)

Traders can use the SMA as a basis for technical analysis in trading cryptocurrency. The indicator shows the standard deviation of 20 occasional moving values and can be viewed on its own, as well as on oscillator graphs. Most software will show the RSI development as a function of the current exchange rate and a path as a kind of bar at certain levels, such as 30, 50, and 70. If the index breaks these levels, it means it’s time to sell.

Simple moving averages can be calculated by dividing the number of consecutive prices over a period by the total number of periods. Using the example above, Tesla shares closed at $10, $12, and $14 over a five-day period. The simple moving average is $11.6. Using this indicator, traders can predict future price movements in the cryptocurrency market. It is recommended to trade alongside a trend rather than sideways.

SMA can be confusing if over-complicated. They are useful to help traders establish their own basic rules and strategies. During a bearish trend, a fast SMA crosses the slow SMA, indicating a correction or reversal in the trend. By identifying when SMA crosses, traders can also identify potential buying and selling points. Traders can use SMA as a guide to analyze cryptocurrency price trends.

Besides using SMA as a base for your trading strategy, it is important to also consider other technical indicators. Moving averages are considered lagging indicators and react much slower to price changes than other technical indicators. In this context, using SMAs to monitor price movements is recommended as a supplement to other technical tools. These indicators should not be used as a sole indicator for trading crypto.

On-Balance-Volume (OBV)

The on-balance-volume indicator (OBV) is an important technical analysis tool to use in trading crypto. It is best known for its use in the stock market, where swing traders use it to identify quiet accumulation. Quiet accumulation refers to when smart money buys and sells an asset without significantly affecting the price. By identifying such accumulation, traders can enter a trade at a lower price than the current one.

The OBV is a simple indicator that measures the volume of a specific crypto pair. It is based on the idea that volume follows price, and so it is both positive and negative. The more positive the volume, the higher the price will go. If the volume decreases, the price will follow. If the volume is negative, then a trader would avoid the trade.

The OBV indicator can be a good tool for identifying early signals, but it’s important to note that it can sometimes give false signals. It’s also best to use other indicators in conjunction with OBV to eliminate false signals. You can combine the OBV indicator with other tools and indicators to make sure you’re making the right decisions. If you are new to crypto trading, the OBV indicator can be very helpful in learning the ins and outs of the market.

The OBV indicator uses volume flows to predict changes in the underlying asset. It’s volume dependent, and it looks for big institutional trades and price met by sellers. By identifying a trendline and price breakout, you can make a profitable trade. A bearish divergence between OBV and price is a sign of smart money selling into retail.

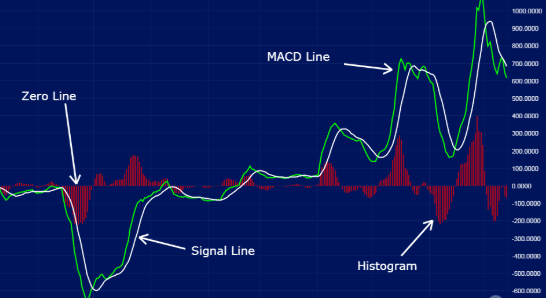

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is an important tool for analyzing the performance of assets and cryptos. It can be used as a basic indicator, but it has some limitations. It rarely reaches 100, and values over 85 or below fifteen are considered extremely overbought or oversold. As with any other indicator, RSI can give you the wrong signals, so it is important to use it with care and research.

The RSI indicator is a momentum indicator that identifies overbought and oversold market conditions. Its calculation is based on 14 periods (each candle represents one period) and is most useful in oscillating markets. In other words, it can tell you whether the market is overbought or oversold, and can be used to determine entry and exit points. The RSI indicator can be used to make accurate predictions in the crypto market.

The RSI is the most versatile technical indicator and oscillator used in the cryptocurrency market. It can be used to trade reversals, trending markets, price retracements, and sideways markets. You can find trade opportunities with RSI if prices are moving higher than expected or falling below expectations. Using RSI as a basic indicator to trade crypto can help you increase your success rate in the crypto market.

The RSI oscillates between zero and 100. When it reaches 100, the price is considered overbought. Conversely, when it goes below twenty, it is considered oversold. RSI can stay in the oversold region for extended periods during a strong trend. The RSI can also help you identify support and resistance levels. It is best used with a weekly or monthly time frame.

Fibonacci retracement indicator

Using a Fibonacci retracement indicator is a powerful way to determine potential trade entry and exit levels. The Fibonacci numbers, named for their sequence, are commonly found in nature. They can be found in DNA Structure and even in the spiral shells of seashells. The sequence was created by mathematician Leonardo Fibonacci and is based on the ‘golden ratio’, which is also known as the ‘divine proportion’.

Traders can also use the Fibonacci retracement indicator with other technical analysis indicators to identify important levels to trade. These levels can be used as stop-loss orders and exits, but traders should not rely on this method solely. For example, a trader can take a profit at 50% of the Fibonacci level, and a second strategy is to use position sizing to hedge their trades and look for higher gains on the rest of the position.

The Fibonacci retracement indicator can be used to draw a line between two important price points on a chart. The price of a given cryptocurrency is compared to its previous high and low points, and the Fibonacci retracement indicator can also be used to forecast a potential trend reversal. The Auto Fib Retracement tool on TradingView makes this task easier by automatically identifying two relevant price points on the chart and calculating a retracement range for the price.

Using the Fibonacci retracement indicator is a smart move for those who want to learn how to trade cryptocurrency successfully. Fibonacci retracement indicators have become increasingly popular with the advent of cryptocurrency exchanges. Using them can give you the edge over other traders, even if you are new to the crypto world. If you have any doubts or would like to learn more about using a Fibonacci retracement indicator, please read on.

Liquidity indicator

You might be wondering how to use a liquidity indicator to trade crypto. There are a few methods available, but it all depends on what you’re looking for. The key is to find a measure that captures the time series variation in liquidity as well as cross-exchange differences. The best proxies are those based on closing prices and high, low, and closing prices. A liquidity indicator may not be the best choice for all situations, but it will provide some valuable information when used correctly.

The best way to determine liquidity is to monitor trading volumes on exchanges that offer large volumes. These exchanges tend to be high-volatile, so investors rely on lower-frequency transaction-based data. The most accurate liquidity measures are daily high, low, and closing prices. The relative performance of these three measures is not affected by liquidity regime, but the two best indicators outperform each other during periods of high volume and volatility. As a result, it is wise to use several different measures of liquidity for comparison purposes across exchanges.

One way to determine liquidity is to look at the order book. The order book displays buy and sell orders, and is a valuable indicator of liquidity. When a market is very liquid, it allows you to enter and exit positions without affecting price. When the market is low in liquidity, the price of an asset will fluctuate by a certain amount in a matter of minutes, which can make the difference between a large profit or a significant loss.

Moreover, the volume and Bid-Ask spread can also help you determine the liquidity of a market. If a cryptocurrency is illiquid, it is likely that traders will find it difficult to make a profit in that market. A liquidity indicator will tell you which exchanges are most active. A high volume means more people are buying and selling. If there are many transactions, then that currency is likely to be illiquid.