04 Jul

Bitcoin has slid below the psychological threshold of $20,000 and the other top currencies are under pressure, ladies and gengtlemen we are living a recession in the crypto market. In addition, Coinbase Global Inc. recently announced plans to cut 1,100 jobs. This news has fueled speculation that we’re experiencing a dot-com bubble-like decline. And some influential investors have been promoting cryptocurrency investments. But are these claims true? Let’s discuss this topic in more detail. We’ll start by examining what we mean by “recession” in the crypto market.

Bitcoin has fallen below the psychological threshold of $ 20,000

Earlier last week, the price of bitcoin fell below the psychological threshold of $ 20,000 for the second time since late 2020 confirming recession in the Crypto Market. The digital currency plunged 9.7% to less than $18,600 at times. Bitcoin last reached that mark in November 2020, when it peaked at almost $69,000. Since then, it has lost 70 percent of its value. The recent drop could prompt a re-think of the currency’s future.

Other top currencies are under pressure

The economy in the U.S. is facing a recession and other top currencies are experiencing a massive sell-off. The underlying reason may be the fear about the U.S. economy, which could lead to a recession. Despite these concerns, the crypto market has shown some signs of resilience. While stocks have undergone a recent correction, it may still have a positive impact on cryptocurrencies, especially bitcoin.

In a recession, investors seek safe havens and seek out crisis-proof means of storing value. The emergence of cryptocurrencies could fulfill this need. As a result, several European countries have passed legislation to regulate them. While this is not yet a complete solution, investors are starting to understand the concept of scarcity and cryptocurrencies are a good choice. In this article, we’ll consider what’s happening with bitcoin and other top currencies in the crypto market.

Coinbase Global Inc. laid off 1,100 employees

The largest U.S.-based crypto exchange, Coinbase Global Inc., has announced it is laying off as many as 1,100 employees. This comes at a time when the crypto market has seen a massive crash, with Bitcoin losing more than half its value in a year. The digital currency hit an all-time high of $69,000 in November 2021 and is currently trading around $19,500 further confirming the recession in the Crypto Market.

JPMorgan recently downgraded Coinbase stock, citing the crypto market’s decline and plans to ramp up hiring in 2022. The company’s layoffs come at a time when the US Federal Reserve (FED) has been raising interest rates and is dealing with the supply side of the equation to keep inflation in check. Personally, I have a similar feeling about Coinbase.

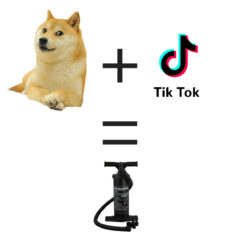

Influential celebrities promote cryptocurrency investments

Influential celebrities have gotten involved in the crypto-space by making their names and reputations known through their investments in Bitcoin and other cryptocurrencies. Gwyneth Paltrow uses digital artwork of a blinking cartoon ape to promote her luxury wellness brand. Matt Damon promoted cryptocurrency during commercial breaks, comparing the investment to scaling Mount Everest or exploring space. Reese Witherspoon has recently made an ominous prediction regarding investments during the recession recession in the Crypto Market.

While cryptocurrency prices have continued to plummet in recent months, celebrities have come under fire for promoting cryptos. Their endorsements are attracting uninformed investors who are not familiar with the industry. In a recent Vox article, senior journalist Emily Stewart discussed the relationship between celebrities and financial products. She was joined by Marketplace host Kai Ryssdal to discuss the pros and cons of celebrity endorsements.

Regulation is needed to prevent another crypto winter

A recent report by UBS warns that there is a high probability of another crypto winter, especially if the current cycle of price drops continues. Interest rate hikes by the Federal Reserve have also put a damper on cryptocurrencies, putting the idea of bitcoin as a store of value to rest. In addition, the technology behind cryptocurrencies is not yet vetted and regulated by government agencies, and regulating the industry could stifle the growth of this promising but baffling industry.

The recent plunge in cryptocurrency prices has been accompanied by the announcement by Coinbase that it is laying off 18% of its staff to prepare for the coming crypto winter. The company grew too fast during the bull market, and as a result is preparing for another recession. Currently, Bitcoin is trading at $42,500, down 40 percent from its peak of $69,000 in November. And this is only the beginning of the crypto winter.